We’ve researched and ranked the top 10 BNPL providers available to UK consumers and retailers, comparing their features, eligibility requirements, and store partnerships to help you make an informed decision about which service best suits your shopping needs.

Table of Contents

What Are Buy Now, Pay Later Services?

Buy now, pay later services allow shoppers to make purchases and delay full payment, typically by splitting the cost into smaller instalments over several weeks or months. Unlike traditional credit cards, most BNPL providers offer interest-free periods and perform only soft credit checks that don’t affect your credit score.

BNPL platforms have seen tremendous growth in the UK, with millions of shoppers now using these services for everything from fashion and electronics to home goods and travel. According to recent data, BNPL transactions accounted for 5% of all online shopping in the UK in 2023.

Important: The UK’s Financial Conduct Authority (FCA) has announced plans to regulate BNPL services more strictly. While these regulations are still being developed, consumers should be aware that BNPL is a form of credit and should be used responsibly.

BNPL Providers Comparison Table

Before we dive into detailed reviews of each provider, here’s a quick comparison of the top 10 BNPL services available to UK shoppers:

| Provider | Interest-Free Period | Payment Structure | Credit Check Type | Late Payment Fee | Maximum Credit Limit |

| Klarna | Up to 30 days or 3 instalments | Pay in 30 days, 3 instalments, or financing | Soft for Pay in 30/3, Hard for financing | £5 after 7-day grace period | Varies by customer |

| Clearpay | 6 weeks | 4 equal instalments every 2 weeks | Soft check | £6 per missed payment | £800 (increases with use) |

| Laybuy | 6 weeks | 6 weekly instalments | Hard check | £6 per missed payment | £1,200 (varies) |

| PayPal Pay in 3 | 6 weeks | 3 equal instalments | Soft check | None | £2,000 |

| Zilch | 6 weeks | Pay 25-50% upfront, rest in 3 instalments | Soft check | £2.50 per late payment | £1,000 (increases with use) |

| Payl8r | 30 days or selected plans | 30 days or 3-18 month plans | Soft check | Varies by agreement | £3,000 |

| DivideBuy | Full term (2-12 months) | Equal monthly instalments | Soft check | None | £6,000 |

| Monzo Flex | 3 months | 3, 6, or 12 monthly instalments | Hard check | None, but affects credit score | £3,000 |

| Openpay | Full term (1-4 months) | Equal monthly instalments | Soft check | £7.50 per missed payment | £1,500 |

| Flava | Full term | Weekly or monthly instalments | Soft check | £5 per missed payment | £120 (groceries focus) |

Ready to explore BNPL options?

Compare these providers in detail below to find the best fit for your shopping needs.

1. Klarna – Most Popular BNPL Provider

Klarna is the most widely used BNPL service in the UK, partnering with over 250,000 merchants including major retailers like ASOS, H&M, and Marks & Spencer. Founded in Sweden in 2005, Klarna has become a household name in the UK BNPL market.

Key Features

- Pay in 30 days: Complete payment within 30 days of purchase with no interest or fees

- Pay in 3: Split payment into three equal, interest-free instalments over two months

- Financing options: Longer-term financing with interest (representative APR 18.9%, variable)

- Klarna app: Manage payments, browse partnered stores, and receive payment reminders

- Klarna Card: Physical card for in-store BNPL purchases

Eligibility Requirements

To use Klarna, you must be at least 18 years old, have a UK address, and a valid debit or credit card. Klarna performs a soft credit check for Pay in 30 and Pay in 3 options, which won’t affect your credit score. For financing options, a hard credit check is required.

Fees and Penalties

Klarna charges a £5 late payment fee if payment is not made 7 days after the due date. Missed payments may be reported to credit agencies for financing options but not for Pay in 30 or Pay in 3.

Ready to try Klarna?

Join millions of UK shoppers using Klarna for flexible payments at thousands of retailers.

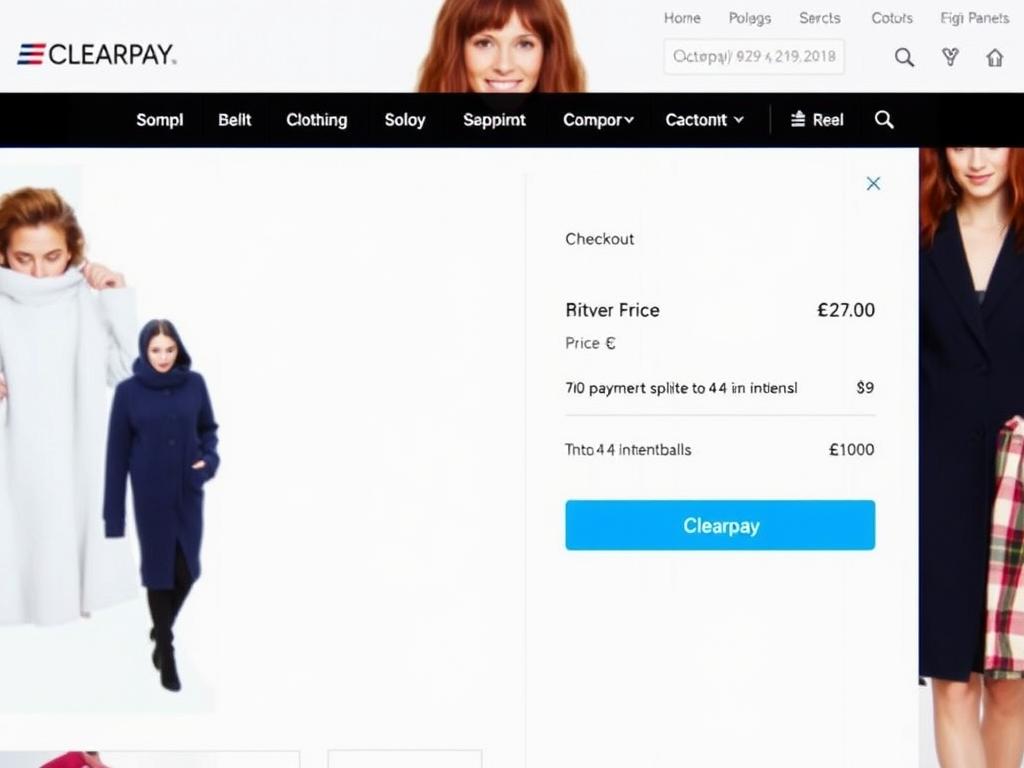

2. Clearpay – Best for Fashion Retailers

Clearpay (known as Afterpay outside the UK) has quickly gained popularity among UK shoppers, especially for fashion purchases. The service partners with over 6,500 UK retailers including ASOS, JD Sports, and Marks & Spencer.

Key Features

- Pay in 4: Split payments into four equal, interest-free instalments over six weeks

- Automatic payments: Scheduled payments are automatically taken from your linked card

- Clearpay app: Manage payments and browse partnered retailers

- Payment reminders: Receive notifications before payments are due

- In-app shopping directory: Discover retailers that accept Clearpay

Eligibility Requirements

You must be at least 18 years old with a UK address and a valid debit or credit card to use Clearpay. The service performs a soft credit check that won’t impact your credit score. Initial spending limits are typically lower but increase with positive payment history.

Fees and Penalties

Clearpay charges a £6 late fee for missed payments, with an additional £6 fee if the payment remains unpaid after 7 days. The maximum late fees are capped at 25% of the order value or £36, whichever is less.

Shop now with Clearpay

Split your payments into 4 with no interest at thousands of UK fashion retailers.

3. Laybuy – Best for Weekly Payments

Laybuy offers a unique weekly payment structure, allowing UK shoppers to spread costs over six weeks. The New Zealand-based company has partnered with hundreds of UK retailers including ASOS, WH Smith, and Footasylum.

Key Features

- 6 weekly payments: Pay one-sixth of the purchase price upfront and the remainder in five weekly instalments

- Laybuy Boost: Top up your spending limit for larger purchases

- Laybuy app: Manage payments and browse partnered retailers

- Automatic payments: Scheduled from your registered card

- Laybuy Marketplace: Directory of participating retailers

Eligibility Requirements

Laybuy requires users to be at least 18 years old with a UK address and a valid payment card. Unlike some competitors, Laybuy performs a hard credit check, which may temporarily impact your credit score. Initial spending limits typically range from £60 to £600 based on your credit assessment.

Fees and Penalties

Laybuy charges a £6 late fee for each missed payment. Continued missed payments may be reported to credit reference agencies and affect your credit score.

Try Laybuy’s weekly payment plan

Spread your payments over 6 weeks with no interest at hundreds of UK retailers.

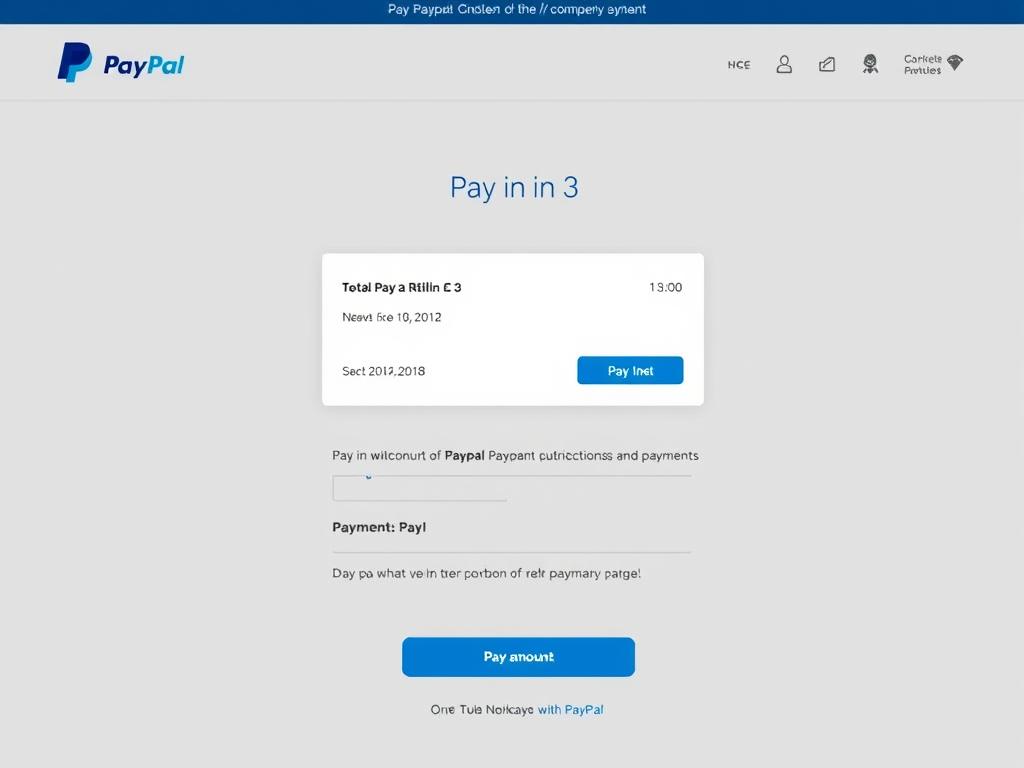

4. PayPal Pay in 3 – Most Trusted Provider

PayPal’s entry into the BNPL market brings the trust and security of one of the world’s largest payment processors. PayPal Pay in 3 is accepted at millions of online retailers where PayPal is available as a payment method.

Key Features

- Pay in 3: Split payment into three equal, interest-free instalments over two months

- Wide acceptance: Available at millions of online retailers that accept PayPal

- PayPal protection: Same buyer protection as standard PayPal transactions

- No separate app needed: Manage through your existing PayPal account

- Automatic payments: Scheduled from your registered PayPal payment method

Eligibility Requirements

You must have a PayPal account in good standing, be at least 18 years old with a UK address, and pass PayPal’s soft credit check. Purchases must be between £30 and £2,000 to qualify for Pay in 3.

Fees and Penalties

PayPal Pay in 3 doesn’t charge late fees, but missed payments may affect your ability to use the service in the future and could potentially impact your credit score if payments remain outstanding for an extended period.

Use PayPal Pay in 3 today

Split your payments with the security and trust of PayPal at millions of online retailers.

5. Zilch – Best for Universal Spending

Zilch offers a unique approach to BNPL with its virtual Mastercard that works at any online retailer that accepts Mastercard, even if they don’t have a direct partnership with Zilch. This makes it one of the most versatile BNPL options for UK shoppers.

Key Features

- Zilch Card: Virtual Mastercard for use anywhere online

- Pay in 4: 25% upfront, then three bi-weekly instalments

- Zilch Anywhere: Use at any online retailer that accepts Mastercard

- Cashback rewards: Earn 2% back in Zilch Rewards when paying in full

- Tap and Pay: In-store payments via Apple Pay or Google Pay

Eligibility Requirements

You must be at least 18 years old with a UK address and bank account. Zilch performs a soft credit check and uses open banking to assess affordability. Initial spending limits typically start around £200 and increase with positive payment history.

Fees and Penalties

Zilch charges a £2.50 late fee per missed payment. Continued missed payments may result in account suspension and could be reported to credit reference agencies.

Shop anywhere with Zilch

Use Zilch’s virtual card to pay in instalments at any online retailer, even those without BNPL options.

6-10: Other Top BNPL Providers for UK Shoppers

6. Payl8r

Payl8r specializes in longer-term financing options with both interest-free and interest-bearing plans. It’s particularly popular for higher-value purchases like electronics and furniture.

- Speedy: 0% interest if paid within 30 days

- Split: 3-18 month payment plans (interest applies)

- Spread: Selected 0% interest plans

Eligibility: 18+ with UK address, bank account, and employment

Credit check: Soft check initially

7. DivideBuy

DivideBuy offers interest-free instalment plans for 2-12 months, making it ideal for larger purchases that need more time to pay off than typical BNPL services offer.

- Flexible terms: 2-12 month payment plans

- Interest-free: No interest on any plans

- No early repayment charges: Pay off early at any time

Eligibility: 18+ with UK address and bank account

Credit check: Soft check

8. Monzo Flex

Offered by digital bank Monzo, Flex allows customers to split payments into 3, 6, or 12 monthly instalments, with the 3-month option being interest-free.

- 3 months: Interest-free instalments

- 6 or 12 months: 19% APR (variable)

- Retroactive splitting: Split past purchases up to 14 days old

Eligibility: Monzo account holders, 18+

Credit check: Hard check

9. Openpay

Openpay focuses on specific retail sectors including fashion, homeware, and automotive, offering payment plans of 1-4 months with the first payment made at purchase.

- Payment plans: 1-4 month interest-free plans

- First payment upfront: Pay a portion at purchase

- Sector focus: Strong in automotive and home improvement

Eligibility: 18+ with UK address and payment card

Credit check: Soft check

Late fees: £7.50 per missed payment, capped at £15

10. Flava

Flava is unique among BNPL providers as it focuses specifically on groceries, allowing customers to spread the cost of food shopping over weekly or monthly instalments.

- Grocery focus: Dedicated to food shopping

- Payment options: Weekly or monthly instalments

- Flava Marketplace: Online grocery store with BNPL

Eligibility: 18+ with UK address and bank account

Credit check: Soft check

Late fees: £5 per missed payment

UK Regulations for BNPL Services

The UK’s Financial Conduct Authority (FCA) announced in February 2021 that BNPL services would face stricter regulation. While these regulations are still being developed, they aim to provide greater consumer protection for BNPL users.

Current Regulatory Status

Currently, most BNPL providers operate under exemptions in the Consumer Credit Act, meaning they don’t need to be fully FCA-regulated. This is expected to change with upcoming regulations that will require:

- Affordability checks before lending

- Fair and clear terms and conditions

- Proper handling of customer complaints

- FCA authorization for BNPL providers

- Access to the Financial Ombudsman Service for disputes

Consumer Protections

While waiting for full regulation, UK consumers using BNPL should be aware of existing protections:

- Section 75 protection: Does NOT apply to most BNPL purchases (unlike credit cards)

- Chargeback: May be available through your bank for disputed transactions

- Complaints: Direct to the provider first, then to the Financial Ombudsman if eligible

- Data protection: Covered by UK GDPR and Data Protection Act 2018

Important: For financial difficulties related to BNPL, contact the MoneyHelper service (formerly Money Advice Service) at 0800 138 7777 or visit moneyhelper.org.uk for free, impartial advice.

How to Choose the Right BNPL Provider

With so many BNPL options available to UK shoppers, choosing the right provider depends on your specific needs and shopping habits. Here are key factors to consider:

When BNPL Makes Sense

- For planned purchases you can comfortably repay on schedule

- When you need to spread costs over a short period

- For trying items before committing (e.g., clothing)

- When the retailer you’re shopping with offers it seamlessly

- If you’re confident in your ability to manage repayments

When to Avoid BNPL

- If you’re already struggling with debt or budgeting

- For impulse purchases you might regret

- When you need Section 75 protection (use a credit card instead)

- If you’re likely to miss payments and incur fees

- For essential items if you have no backup payment plan

Match the Provider to Your Needs

- For fashion shopping: Clearpay or Klarna have the most partnerships

- For longer payment terms: DivideBuy or Payl8r offer extended plans

- For universal acceptance: Zilch or PayPal work at most retailers

- For weekly budgeting: Laybuy’s six weekly payments may suit your pay schedule

- For grocery shopping: Flava specializes in food purchases

Questions to Ask Before Using BNPL

- Can I afford the repayments, even if my financial situation changes?

- Have I checked if there are any fees or interest charges?

- Do I understand what happens if I miss a payment?

- Is this provider regulated or working toward FCA regulation?

- Would a different payment method offer better consumer protection?

Compare BNPL options for your next purchase

Find the right payment solution based on your shopping needs and financial situation.

Alternatives to Buy Now, Pay Later

While BNPL services offer convenience, they’re not always the best payment option. Consider these alternatives for your UK shopping needs:

Credit Cards

- 0% purchase cards: Many UK cards offer 0% interest on purchases for 12+ months

- Section 75 protection: Legal protection for purchases between £100-£30,000

- Rewards: Cashback, points, or air miles on spending

- Build credit: Responsible use improves credit score

- Caution: High interest after promotional periods

Debit Cards

- Spend what you have: Avoid debt completely

- No credit check: Available with basic bank accounts

- Budgeting: Some UK banks offer spending insights and categories

- Chargeback: Some purchase protection (though less than credit cards)

- Caution: No ability to spread payments

Savings & Budgeting

- Sinking funds: Save regularly for planned purchases

- Budgeting apps: UK apps like Emma, Monzo, or Yolt

- Round-up savings: Many UK banks offer automatic saving features

- Interest earned: Money grows while saving, unlike paying interest

- Caution: Requires advance planning

“While BNPL can be a useful tool, the best approach is often to save for purchases in advance. If you do use BNPL, treat it like any other debt and ensure you have a clear plan for repayment.”

Final Thoughts: Using BNPL Responsibly

Buy Now, Pay Later services offer UK shoppers flexibility and convenience when used responsibly. The top providers we’ve reviewed—Klarna, Clearpay, Laybuy, PayPal Pay in 3, and Zilch—each offer unique benefits that may suit different shopping needs and habits.

As the UK regulatory landscape evolves, it’s important to stay informed about how these changes might affect your consumer rights and the operations of BNPL providers. Always read the terms and conditions before using any BNPL service, and ensure you have a clear plan for making repayments on time.

Remember that BNPL is a form of credit, and while it can be a useful tool for managing cash flow, it should be used thoughtfully as part of a broader approach to personal finance. By choosing the right provider for your needs and using the service responsibly, BNPL can be a valuable addition to your payment options when shopping with UK retailers.

Ready to explore BNPL options?

Compare the top providers and find the best fit for your shopping needs.

Disclaimer: This information is accurate as of January 2024. BNPL services and regulations may change. Always check the latest terms and conditions directly with providers before making financial decisions.

Frequently Asked Questions About BNPL

Does using BNPL affect my credit score?

Most BNPL providers perform a soft credit check when you apply, which doesn’t affect your credit score. However, missed or late payments may be reported to credit reference agencies and could negatively impact your score. Some providers like Laybuy perform hard credit checks, which may temporarily affect your score.

What happens if I miss a BNPL payment?

The consequences vary by provider. Most charge late fees (typically £5-£6 per missed payment), may block you from making further purchases, and could report persistent non-payment to credit agencies. Some providers like PayPal don’t charge late fees but may still restrict account access.

Are BNPL services regulated in the UK?

Currently, most BNPL services operate under exemptions in the Consumer Credit Act and aren’t fully regulated by the FCA. However, the UK government has announced plans to bring BNPL under FCA regulation. This regulatory framework is still being developed and implemented.

Can I return items purchased with BNPL?

Yes, you can return items purchased with BNPL according to the retailer’s return policy. When you return an item, the retailer notifies the BNPL provider, who will then cancel or adjust your remaining payments. If you’ve already made some payments, you’ll typically receive a refund for those amounts.

Is there a limit to how much I can spend with BNPL?

Yes, all BNPL providers set spending limits based on factors like your payment history and creditworthiness. Initial limits are typically lower (£200-£500) and may increase over time with positive payment history. Each provider has different maximum limits, ranging from around £800 with Clearpay to £6,000 with DivideBuy for certain purchases.