As a small business owner, it can take time to balance the daily operations of your business with long-term financial planning. However, financial planning is essential for small businesses to succeed and grow. In this article, we will explore the strategies that small business owners can use to effectively plan their finances for success.

Table of Contents

Understanding Financial Planning for Small Business Owners

Financial planning creates a roadmap to achieve goals by analyzing the current financial situation, setting achievable goals, and creating a plan. Small businesses need to make informed financial decisions aligned with their objectives.

The steps involved in financial planning for small businesses include the following:

- Analyzing your current financial situation

- Setting financial goals

- Creating a financial plan

- Implementing the financial plan

- Monitoring and reviewing the financial plan

Developing a Long-Term Financial Strategy

Long-term financial planning is essential for small businesses to achieve their financial goals. It involves developing a financial plan aligning with your business objectives and creating a roadmap.

To develop a long-term financial strategy, small business owners should:

- Determine their financial goals

- Identify their current financial position

- Create a financial plan that aligns with their business objectives

- Implement the financial plan

- Monitor and review the financial plan regularly

Measuring Progress Towards Financial Goals

Setting achievable financial goals is crucial for small businesses to measure their financial performance accurately. Business owners need to track and measure their financial performance regularly to identify potential areas for improvement.

To measure progress toward financial goals, small business owners should:

- Set achievable financial goals

- Track and measure financial performance

- Identify potential areas for improvement

- Adjust their financial plan as needed

Managing Cash Flow Effectively

Effective cash flow management is essential for small businesses to maintain financial stability. Business owners must manage their cash flow effectively to ensure they have enough funds to cover their expenses and invest in their business’s growth.

Small business entrepreneurs should:

- Monitor their cash flow regularly

- Create a cash flow forecast

- Implement cash flow management techniques

- Improve their cash flow management practices continuously

Prioritizing Expenses and Capital Purchases

Small business owners must prioritize their expenses and capital purchases to ensure they invest their resources in the right areas. It involves identifying necessary expenses for business growth, evaluating capital purchase decisions, and prioritizing expenses for effective financial planning.

To prioritize expenses and capital purchases, small business owners should:

- Identify necessary expenses for business growth

- Evaluate capital purchase decisions

- Prioritize expenses for effective financial planning.

- Re-evaluate their expenses and capital purchases regularly

Determining the Right Time for Mergers, Acquisitions, or a Sale

Mergers, acquisitions, or a sale can be an effective way for small businesses to achieve their financial goals. However, evaluating the financial implications of these decisions and conducting them successfully is essential.

To determine the right time for mergers, acquisitions, or a sale, small business owners should:

- Evaluate the financial implications of these decisions

- Consult financial advisors, lawyers, and accountants for professional advice

Funding Future Opportunities

Small businesses need to identify and evaluate future opportunities to grow their business. It involves determining the best way to fund these opportunities through loans, equity, or other funding options.

To fund future opportunities, small business owners should:

- Identify and evaluate future opportunities

- Determine the best way to fund these opportunities

Selecting the Appropriate Financial Advisor for Your Business

Financial advisors can play a crucial role in helping small businesses achieve their financial goals. Selecting the appropriate financial advisor can be intimidating. When evaluating potential advisors, it’s important to consider their qualifications, experience, and track record. Look for an advisor who has experience working with small businesses and who can offer personalized advice tailored to your specific needs. You should also consider their fee structure and ensure it aligns with your budget.

Incorporating Tax Planning into Your Financial Strategy

Tax planning is important for small businesses to minimize tax liability and increase after-tax income. This includes using deductions, managing withholding, and utilizing retirement accounts. A qualified tax professional can help navigate complex laws.

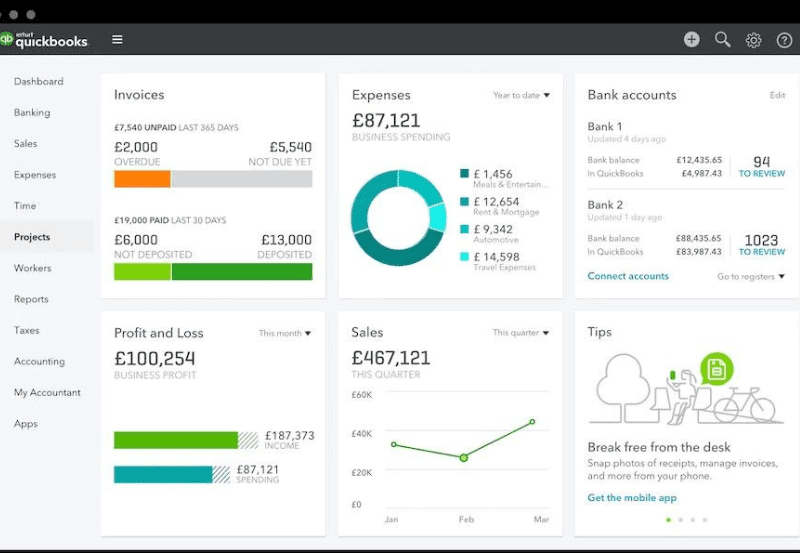

Financial Planning Tools for Small Business Owners

Small business owners can access financial planning tools that track financial performance, analyze cash flow, and develop long-term strategies. These tools can range from spreadsheets to accounting software like QuickBooks, Xero, and FreshBooks. Choosing a user-friendly tool that meets your needs is essential for effectively managing finances and making informed decisions.

Building a Successful Financial Planning Team

A successful financial planning team is crucial for small business success. The team should include professionals like financial advisors, accountants, and attorneys who work together to develop and implement financial strategies. Look for experienced professionals who share your values and vision for the future.

Managing Risk in Your Financial Plan

A comprehensive risk management strategy is crucial for small businesses to ensure long-term success. Mitigating risks like economic downturns, natural disasters, and legal liabilities can be done by obtaining insurance, implementing a continuity plan, and developing a crisis management plan.

Monitoring and Updating Your Financial Plan

Regularly monitoring and updating your financial plan for your small business is essential. Review financial performance, track progress, and identify areas for improvement. This keeps the plan relevant and effective for achieving long-term objectives.

Conclusion

Financial planning is a crucial component of small business owners. By developing a comprehensive financial strategy that aligns with your business objectives, you can effectively manage your cash flow, prioritize expenses, and fund future opportunities. With the help of a qualified financial advisor and the right financial planning tools, you can develop a plan that meets your specific needs and helps you achieve your financial goals. Remember to regularly monitor and update your financial plan to ensure it remains relevant and effective in helping you navigate the complex financial landscape of small business ownership.

To access more informative content then, Click here.